Last Updated on January 3, 2026 by allstealdeals

Tax season can be stressful for any investor, but for cryptocurrency enthusiasts, it’s often a nightmare of complex calculations, missing transaction data, and confusing regulations. If you’ve been trading, staking, or investing in digital assets, you’re likely aware of the headache that comes with calculating gains, losses, and tax obligations across multiple exchanges and wallets. This is where CoinLedger steps in as a game-changer.

As the #1 cryptocurrency tax software platform, CoinLedger has been helping investors since 2018 navigate the complex world of crypto taxation with automated tools that save time and reduce errors. Whether you’re a casual Bitcoin holder or an active DeFi participant, understanding your tax obligations is crucial for staying compliant with regulations. We’ve secured an exclusive CoinLedger coupon code that can help you manage your crypto taxes more affordably while ensuring accuracy and compliance.

In this comprehensive guide, we’ll explore everything CoinLedger offers, how it simplifies crypto tax calculations, current discount opportunities, and whether this software is worth your investment. As experts in finding the best top deals today, we’re excited to help you save money while staying tax-compliant.

What is CoinLedger?

CoinLedger (coinledger.io) is a leading cryptocurrency tax software platform founded in 2018 that specializes in helping users calculate and manage their crypto taxes quickly and accurately. Based in Kansas City with a team of 11-50 dedicated professionals, CoinLedger has established itself as the go-to solution for individuals and businesses looking to streamline their cryptocurrency tax obligations.

The platform addresses one of the most challenging aspects of cryptocurrency investing: tracking and calculating tax liabilities across multiple exchanges, wallets, and blockchain networks. Unlike traditional investment platforms where brokers provide comprehensive tax documents, cryptocurrency transactions often occur across dozens of different platforms, making manual calculation nearly impossible for active traders.

CoinLedger automates this entire process by connecting directly to users’ wallets and exchanges, importing transaction history, and performing complex calculations that would otherwise take hundreds of hours to complete manually.

Current CoinLedger Discount Codes (May 2025)

If you’re ready to simplify your crypto tax situation, we have excellent news. We’ve partnered with CoinLedger to offer our readers an exclusive discount:

This discount applies to all of CoinLedger’s paid plans, making professional-grade crypto tax software more accessible to investors at every level.

CoinLedger Pricing Structure

CoinLedger offers tiered pricing based on transaction volume:

- Free Plan: Preview reports for up to a limited number of transactions

- Hobbyist Plan: Suitable for casual investors with moderate transaction volume

- Trader Plan: Designed for active traders with higher transaction counts

- Professional Plan: For high-volume traders and institutional users

The exact pricing varies based on current promotions, but our CRYPTOTAX10 code provides 10% savings across all paid tiers.

How to Apply Your CoinLedger Coupon Code

Redeeming your exclusive CoinLedger promo code is straightforward:

- Visit CoinLedger’s website

- Create your account or log in if you already have one

- Import your transactions to see which plan you need

- Select your desired subscription plan

- At checkout, look for the “Promo Code” or “Coupon Code” field

- Enter CRYPTOTAX10 in the field

- Click “Apply” to see your 10% discount reflected in the total

- Complete your purchase with the reduced amount

The discount will be applied to your subscription, providing ongoing savings throughout your billing period.

Are There Any Expired CoinLedger Coupon Codes?

During our research, we found several previously active discount codes that are no longer valid:

- TAXSAVER15 (expired March 2025)

- CRYPTO2024 (expired December 2024)

- NEWYEAR20 (expired January 2025)

If you encounter these codes elsewhere online, they won’t work. We recommend using our confirmed active code CRYPTOTAX10 for guaranteed savings.

When Will CoinLedger Offer New Discounts?

Based on historical patterns, CoinLedger typically offers promotional pricing during:

- Tax Season (January through April) – when demand is highest

- End of Calendar Year – helping users prepare for upcoming tax filing

- Black Friday/Cyber Monday – general promotional periods

- Product Updates – when new features are launched

The next anticipated discount period may be around the 2026 tax season, but there’s no guarantee future discounts will match our current exclusive offer. If you need crypto tax software, taking advantage of the current 10% discount is recommended.

How CoinLedger Simplifies Crypto Tax Calculations

Understanding how CoinLedger works helps explain why it’s become the preferred choice for crypto investors dealing with tax obligations:

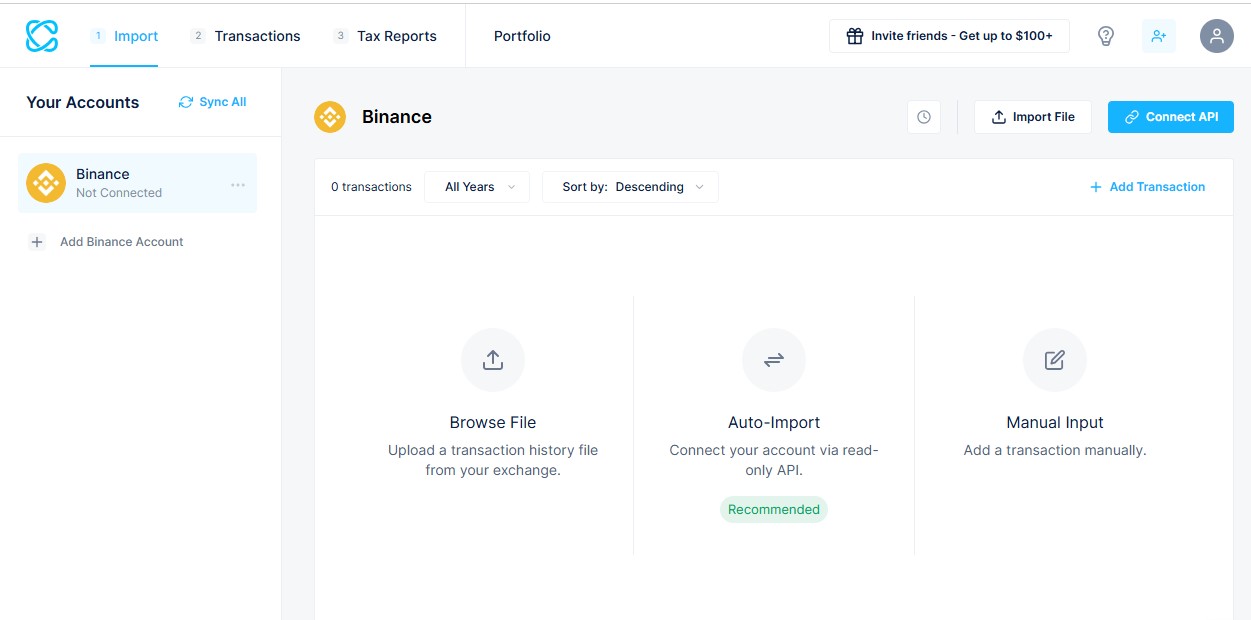

Automatic Transaction Import

One of CoinLedger’s most valuable features is its ability to connect with hundreds of exchanges and wallets, including:

- Major Exchanges: Coinbase, Binance, Kraken, Gemini, KuCoin, and dozens more

- Popular Wallets: MetaMask, Ledger, Trezor, Trust Wallet

- DeFi Platforms: Uniswap, SushiSwap, Compound, Aave

- Blockchain Networks: Ethereum, Polygon, Binance Smart Chain, and others

This connectivity eliminates the need for manual data entry, which is both time-consuming and error-prone. Users simply authorize CoinLedger to access their transaction history, and the platform automatically imports all relevant data.

Comprehensive Transaction Categorization

CoinLedger automatically distinguishes between different types of cryptocurrency activities:

Taxable Events:

- Selling cryptocurrency for fiat currency

- Trading one cryptocurrency for another

- Receiving staking rewards or mining income

- Earning from DeFi yield farming

- NFT transactions

Non-Taxable Transfers:

- Moving crypto between your own wallets

- Purchasing cryptocurrency with fiat money

- Receiving gifts (though this may have other tax implications)

This categorization is crucial because many crypto users inadvertently report non-taxable events as taxable, leading to overpayment of taxes.

Advanced Cost Basis Calculation

Calculating cost basis—the original value of an asset for tax purposes—becomes incredibly complex with cryptocurrency due to factors like:

- Multiple purchases at different prices

- Partial sales requiring specific identification methods

- DeFi interactions that may affect cost basis

- Missing historical price data

CoinLedger handles these calculations automatically, using appropriate accounting methods like FIFO (First In, First Out) or specific identification to optimize your tax situation legally.

Missing Data Detection and Resolution

One of CoinLedger’s standout features is its ability to identify missing cost basis data and alert users to potential issues. The platform flags transactions that may lead to incorrect tax calculations, allowing users to correct problems before filing their returns. This proactive approach helps prevent overpayment and reduces audit risk.

CoinLedger Features and Benefits

Automated Portfolio Tracking

CoinLedger provides real-time portfolio tracking across all connected accounts, giving users a comprehensive view of their cryptocurrency holdings and performance. This feature is valuable not just for tax purposes but for overall investment management.

Professional Tax Report Generation

With a single click, users can generate comprehensive tax reports including:

- Form 8949: Details of capital gains and losses

- Schedule D: Summary of capital gains and losses

- Income Reports: For staking rewards, mining income, and other taxable events

- Audit Trail Reports: Detailed transaction records for compliance purposes

These reports can be directly imported into popular tax software like TurboTax, TaxAct, H&R Block, and TaxSlayer, streamlining the filing process.

Support for Complex Trading Activities

CoinLedger handles sophisticated trading scenarios that would be nearly impossible to calculate manually:

- Margin Trading: Automatic calculations for leveraged positions on platforms like Kraken

- DeFi Activities: Tracking yield farming, liquidity provision, and governance token rewards

- NFT Transactions: Proper tax treatment for non-fungible token trades and sales

- Staking and Mining: Income recognition and cost basis tracking for validation rewards

Tax Professional Integration

For users working with accountants or tax professionals, CoinLedger allows seamless collaboration. Tax professionals can be granted access to review reports within the platform, eliminating the need to share sensitive financial information via email.

Is CoinLedger Worth the Investment?

When evaluating whether CoinLedger justifies its cost, consider both the direct and indirect value it provides:

Time Savings

Manual crypto tax calculation can easily consume 50-100 hours for active traders. Even at minimum wage, this time has significant value. CoinLedger reduces this to minutes, providing substantial time savings that often exceed the software cost.

Accuracy and Compliance

Tax calculation errors can be costly, leading to:

- Overpayment of taxes due to incorrect calculations

- Underpayment penalties and interest from the IRS

- Audit risk from inconsistent or missing documentation

CoinLedger’s automated calculations and comprehensive reporting reduce these risks significantly.

Professional Features at Consumer Prices

The platform provides enterprise-level tax calculation capabilities at prices accessible to individual investors. Features like missing data detection, multiple accounting method support, and professional tax form generation would typically require expensive accounting software or professional services.

User Testimonials and Reviews

CoinLedger consistently receives positive reviews from users who praise:

- Ease of use for beginners

- Comprehensive feature set for advanced traders

- Accurate calculations that have been verified by tax professionals

- Responsive customer support

- Regular updates to handle new types of crypto activities

Frequently Asked Questions About CoinLedger and Discount Codes

Can I use the coupon code if I already have a free account?

Yes, the CRYPTOTAX10 coupon code works for existing users upgrading to paid plans, as well as new customers.

Does CoinLedger support international tax regulations?

CoinLedger primarily focuses on US tax regulations and forms. Users in other countries should verify compatibility with their local tax requirements.

What happens if I have transactions CoinLedger can’t import automatically?

CoinLedger allows manual transaction entry and CSV uploads for exchanges or wallets that aren’t directly supported. The platform also regularly adds support for new exchanges and wallets.

Can I try CoinLedger before purchasing?

Yes, CoinLedger offers a free plan that allows you to import transactions and preview your tax reports. This lets you evaluate the software’s capabilities before committing to a paid plan.

How does CoinLedger handle privacy and security?

CoinLedger uses bank-level security measures and never stores exchange login credentials. The platform connects using read-only API keys, ensuring your funds remain secure while allowing transaction data access.

What customer support does CoinLedger provide?

CoinLedger offers customer support through email and chat, with additional educational resources including video tutorials on their YouTube channel and comprehensive help documentation.

Conclusion

As cryptocurrency adoption continues to grow and tax regulations become more stringent, having reliable tools to manage your crypto tax obligations becomes essential. CoinLedger stands out as the leading solution in this space, offering automated calculations, comprehensive reporting, and professional-grade features at consumer-friendly prices.

Our exclusive CoinLedger discount code CRYPTOTAX10 provides 10% savings on all paid plans, making this essential tool even more affordable. Whether you’re dealing with simple buy-and-hold investments or complex DeFi activities, CoinLedger can save you dozens of hours while ensuring accuracy and compliance.

Don’t let crypto tax calculations overwhelm you this tax season. Visit CoinLedger today, use coupon code CRYPTOTAX10 at checkout, and take control of your cryptocurrency tax situation with confidence.

For more exclusive discounts on financial tools, software, and other essential services, keep exploring AllStealDeals – your trusted source for the best deals across the web.

Note: This coupon code is offered for a limited time. We recommend securing your discount promptly as crypto tax software demand typically increases during tax season.

Leona Lewis is a Deal Hunter Expert and SEO Content Writer with over 5 years of experience in finding and verifying top deals and coupon codes for online shoppers.

Throughout her career, Leona has worked as a professional coupon hunter and content specialist for leading deal websites including CouponsPlusDeals, BestBuyBestDeals, and CouponMarathon, helping thousands of shoppers save money on their purchases.

As Admin and Lead Content Writer at AllStealDeals.com, Leona personally verifies every coupon code and deal before publishing, ensuring 100% accuracy and value for the community. She specializes in daily coupon verification and testing across 500+ retailers, exclusive deal hunting and flash sale tracking, and e-commerce pricing analysis.

Leona updates coupon codes daily and is dedicated to bringing you only the best verified deals, exclusive coupons, and money-saving shopping tips you can trust.

“My mission is to help every shopper find genuine top deals that actually work—no expired codes, no disappointments, just real savings.”